Last Monday, the ad quality and transparency platform Adalytics generated shockwaves with new research on the high volume of ads on made-for-advertising (MFA) websites. Designed to measure investment in the wake of the ANA’s Programmatic Media Supply Chain Transparency study, the report sheds an unflattering light on where hundreds of prominent brands, including 16 of the 17 named participants in the ANA study, appear online. Within one day, the entire industry was asking how, after the ANA clearly showed that 15% of spend is wasted on MFA, this could still be happening.

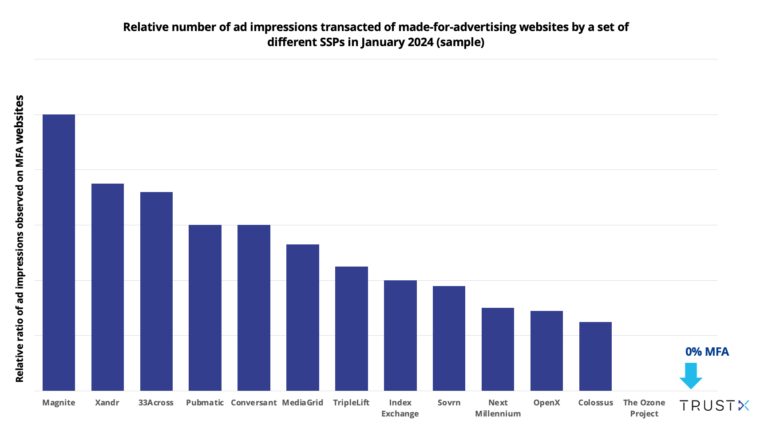

When the ANA’s findings rocked the industry in June 2023, media buyers and ad tech platforms quickly vowed to eradicate MFA from their supply chain. Nine months later, it’s clear that their efforts are still a work in progress. All seven agency holding companies were found to be transacting on MFA for prominent clients, as were the top DSPs, ad networks, exchanges, yield optimization services and most SSPs (save for two). Most confounding, many ads on MFA sported tags from vendors meant to combat this problem, including Integral Ad Science (IAS), DoubleVerify (DV), Oracle Moat, Fou Analytics, Pixalate and HUMAN (formerly White Ops).

With so much talk of MFA, these results leave us wondering: “Why is this still happening?” And more importantly: “How do we fix it?”

You get what you pay for. Except when you don’t.

No one should be more perturbed by all this than advertisers, whose money is being wasted. Next up are premium publishers, who aren’t seeing the kinds of media budgets they deserve.

Media buyers meet MFAs

It’s easy to blame media buyers who have an unquenchable thirst for cheap CPMs. However, it’s unlikely that any brand cited in the research said to their agency, “Let’s buy some MFA.” Most who publicly stepped up and vowed, in good faith, to stem the flow of ad spend to made-for-advertising content likely took steps to do so only to be foiled by an overreliance on MFA exclusion lists and misaligned incentives that prioritize cheap reach over more costly quality. Also to blame is the inherent complexity of the adtech supply-chain, which thrives on secondary, multi-hop auctions through which even the most carefully-curated domain inclusion list becomes lost.

Case in point: across all of the SSPs evaluated by Adalytics, the only two that were totally free of MFA inventory were the two that represented exclusively premium inventory and did not permit secondary auctions: TRUSTX (the company of which I am CEO, which represents premium news, sports and entertainment content publishers across North America) and The Ozone Project (which represents UK news publishers). Kargo, a mobile rich media advertising platform, was also named as MFA-free.

Never let a good crisis go to waste

While last summer’s ANA report erred on the side of caution, this time, major advertisers have been publicly called out, putting pressure on the buy side to take action. These advertisers are seeking answers, and premium publishers are well-positioned to rise to the occasion.

A quality education about MFAs

There’s a timely opportunity for high-quality inventory sellers to coach their client-side and agency partners on how to get more from their media investments. And the good news is that the solutions are actually uncomplicated.

- Establish an inclusion list of high-quality inventory sellers. MFA exclusion lists are like trying to count all the grains of sand on a beach: an exercise in futility.

- Buy through direct paths to programmatic supply—i.e., Brand (or Agency) to DSP to SSP to publisher. Every extra reseller hop in the supply chain adds cost and reduces the likelihood that your client will get what they paid for.

- Demand the data to validate that their media budget went to the publishers they specified. Log level data is the gold standard for verifying that an inclusion list was honored, though with highly trusted partners, detailed reporting may also suffice. Point being, the buyer should ask for data at whatever level of detail they need to be comfortable.

Why are these steps of critical importance? For publishers, every ad dollar diverted from MFA is a dollar that could be spent on quality inventory. Looking through the lens of an advertiser, the reasons to avoid MFA are even more urgent.

The stakes are high for brand advertisers

- MFA is cheap, but cheap can become very expensive. MFA sites notoriously struggle with frequency capping. According to Adalytics, a single site visitor was shown the same ad for one brand 835 times at a cost of $5.49, resulting in an effective CPM of $5491. So, yes, in some cases, you get what you pay for, but not in this one. Encouraging your advertisers to seek out the most direct path to your inventory possible will help avert this kind of disaster.

- MFA isn’t brand-safe. According to Integral Ad Science, 82% of consumers care about the quality of the content in which they encounter a brand’s ads. 75% will have a less favorable opinion about brands whose ads they encounter on sites that spread misinformation. Furthermore, 51% say they are likely to abandon a brand whose ads appear in inappropriate content. Clearly, ad placements on MFA, whether intentional or inadvertent, have a negative impact.

- MFA is unsustainable. Lowering emissions is a top priority for advertisers, and understandably so—according to McKinsey and NielsenIQ, 78% of US consumers care deeply about the sustainability efforts of the brands they buy from. Given that adtech accounts for 1.5% of global energy consumption, programmatic seems like a good place to start. It should give them pause that MFA generates 26% more emissions on average than higher quality sites.

Adalytics’ findings are another chapter in a demoralizing story that affects our entire industry. Seeing the continued MFA waste must be particularly painful for publishers of high-quality content. But sunlight is the best disinfectant. Thanks to Adalytics’ no-holds-barred research, the insidious nature of MFA has been laid bare for all to see. We think the empirical data opens the door for buyer and seller dialogues on the value of premium inventory, which creates a golden opportunity for premium publishers to talk to their clients about redirecting ad spend to where it rightfully belongs.